The early 2000’s saw the growth in online banking and digital payment transactions. The Markets saw a sharp increase in the online spending trends. Hence, as a part of its 5-year growth plan, GT Bank wanted to capitalize and generate revenues out of every digital transaction that was being carried out by their customers.

Most of the online spending being done by customers were spread across various industries and POS. Urban customers could be seen buying flight tickets on a travel portal, or were buying clothing merchandise from their favorite brands that had presence online, Or Purchase music from an itunes store, or Spotify.com from their smartphones or laptops.

GT Bank wanted to create an app that could enable all of these transactions from one app itself called Habari.

Internet Data was precious and very expensive in Nigeria. Not every customer, could afford data that easily and freely. Hence it was of utmost importance that whatever Solution was made should be data friendly and light.

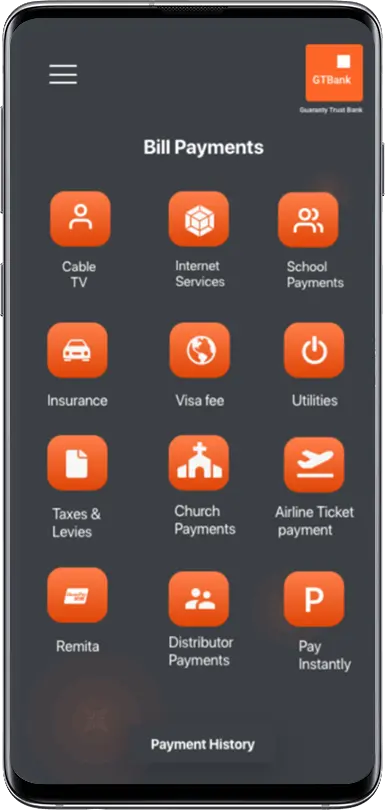

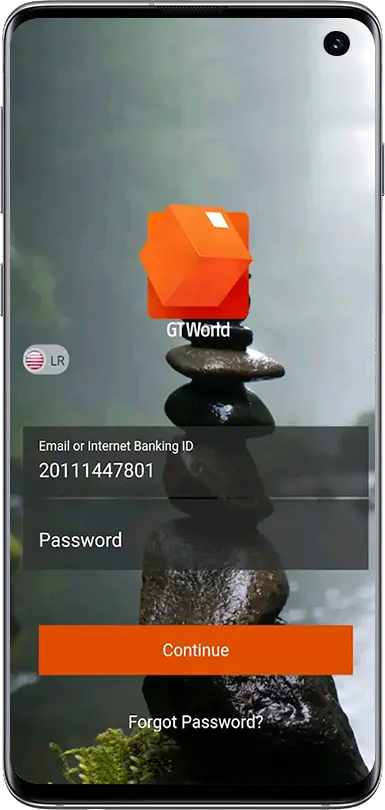

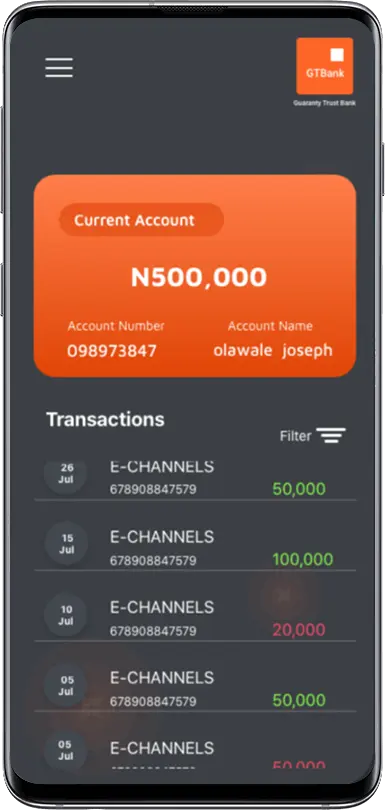

Habari is a module of the Habari application. It is incorporated with advanced functionalities such as a bank account, wallet, and many more. This application supports other trending features that meet the digital age demands and product-related services. When it comes to development, our team faces a major challenge in payment integration service and without a third-party platform, it is fully secure and reliable. With our team we developed a robust and secure Habari module that supports KYC verification, users are able to save the customer’s information if preferred, and users can pay the bill payments easily and without any hassle. It is our successfully launched product in the finance industry.

Since this was a complex project for its time, Solution Analysts decided to break down the project into 3 modules:

Swift

Kotlin

Angular

MasterCard API integration

NodeJS

Elastic Search

New Relic

Xcode

Magento

Amazon Lex

SQLite.Swift DB Integration

Google Maps Integration

MySql

Android Studio

101, Kalasagar Shopping Hub,Opp Sattadhar Saibaba Temple,B/h Sattadhar Bus-stand,Sattadhar,Gujarat-380061

+91 999-894-5667 sales@solutionanalysts.com

sales@solutionanalysts.com

info@solutionanalysts.com

info@solutionanalysts.com

career@solutionanalysts.com

career@solutionanalysts.com

biz.solutionanalysts

biz.solutionanalysts