Financial data is rarely confined to cubes alone. Organizations often need to merge highly structured cube data with flexible relational data to gain a complete financial picture. This is where OneStream Relational Blending in OneStream comes into play. By seamlessly combining cube and relational data, OneStream enables finance teams to build dynamic, flexible, and scalable reporting models that go beyond traditional consolidation.

OneStream Relational Blending is a powerful feature in OneStream that allows you to integrate cube data (highly structured, dimensionalized data used for financial consolidation and reporting) with relational data (flexible, transactional, or detailed data stored in relational tables).

In simple terms, think of cube data as your “official financials” – aggregated, standardized, and structured. Relational data, on the other hand, can include operational or transactional details, such as invoices, project-level costs, or sales pipeline information. OneStream Relational Blending bridges these two worlds, letting you:

Modern finance requires agility. A cube-only model often struggles when users demand:

• Granularity

Finance teams want to view not just consolidated revenue but also the invoices or contracts behind those numbers.

• Flexibility

Relational tables can be adjusted easily without redesigning cube structures.

• Performance

Offloading detailed data into relational tables ensures cubes remain lean and fast.

OneStream Relational Blending makes it possible to design models that are both robust and agile, enabling:

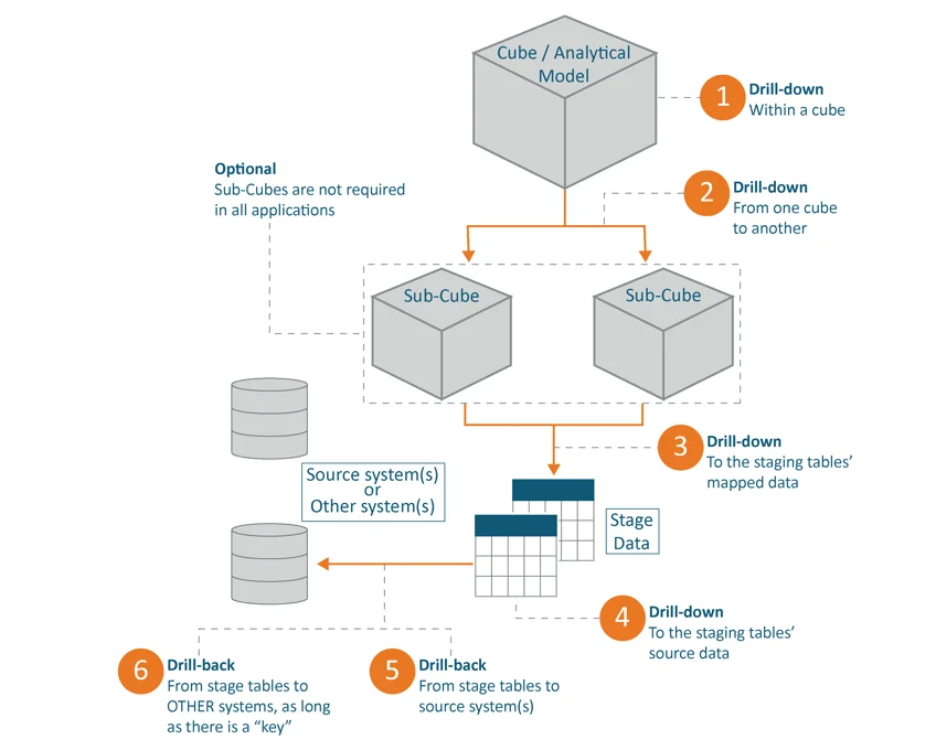

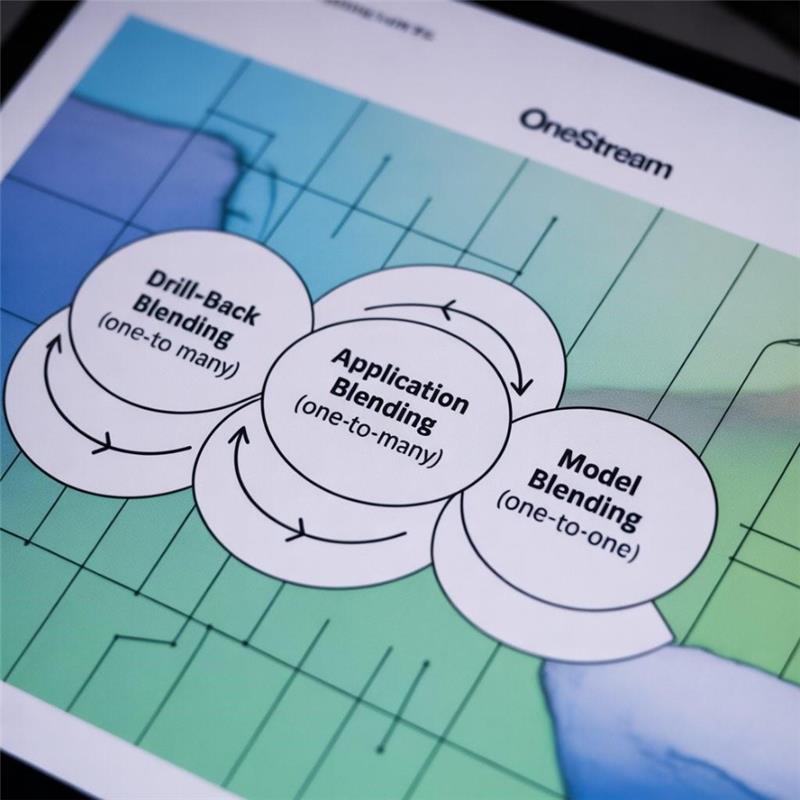

OneStream supports three methods of OneStream Relational Blending. Each serves a distinct purpose and aligns to a relationship pattern between summarized analytic data and detailed relational data.

1) Drill‑Back Blending (One‑to‑Many)

What it is: Provides access to detailed information that does not live in the analytic model. OneStream delivers this out‑of‑the‑box via predefined drill‑back to Stage detail, with additional drill‑back/drill‑around capabilities to external sources.

When to use: You want transparency into transactions driving a cube value (Actuals or Plan) without storing those transactions inside the cube.

Real‑world example: From a P&L variance in a Cube View, a user drills into Accounts Payable invoice lines stored in Stage tables (or an ERP view) to see vendor, date, and document references that explain the variance.

2) Application Blending (One‑to‑Many)

What it is: Leverages OneStream Marketplace Specialty Planning and Compliance applications that collect information in a transactional register. These apps map and load summarized data into the analytic model and also provide predefined transactional‑level reports and drill‑back connectors from cube summaries to the register detail.

When to use: You need a governed data‑entry experience for transactional planning/compliance with seamless summarization to the cube and native drill‑back to the captured records.

Real‑world examples:

• People Planning: Capture employee‑level rows (hire, comp, benefits) in a register; load summarized salary/HC by Cost Center into the cube; drill from cube totals back to the employee register.

• Capital Planning: Capture asset‑level purchases and attributes; load monthly depreciation/CapEx into the cube; drill from depreciation expense to the asset register.

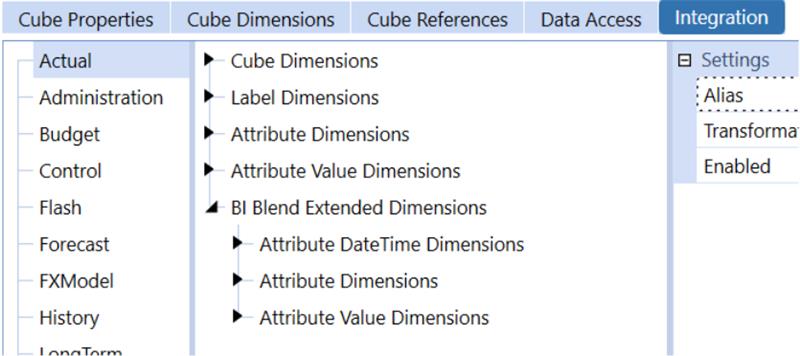

3) Model Blending (One‑to‑One)

What it is: Combines the power of the in‑memory analytic engine with the flexibility of relational storage within a single model. Implemented via the Finance Engine API (functions available under the api.Functions path in a Finance Business Rule), calculations can read/write to relational tables alongside cube intersections.

When to use: Your calculation logic requires relational detail side‑by‑side with cube data (e.g., complex drivers, contract schedules, or shaped datasets) and should execute as part of the Finance Engine.

Real‑world examples:

• Revenue recognition schedules: Store contract line schedules in a relational table and, during calc, allocate revenue to cube periods with the Finance Engine API.

• Driver‑based forecasting: Read SKU‑level drivers (prices, BOMs) from relational tables, multiply by volume stored in the cube, and write results back to the cube—all within the same model.

OneStream Relational Blending empowers organizations to design financial models that are not only consolidated and controlled but also flexible and detailed. By blending cube and relational data, finance teams can:

If your organization is looking to harness the power of OneStream Relational Blending in, our team can help. From designing hybrid models to implementing drill-through solutions, we specialize in building OneStream solutions tailored to your business.

Darshakkumar Prajapati

Lead Engineer

Darshak is a Lead Software Development Engineer with strong expertise in OneStream, including Cube Views, Dashboards, Business Rules, and advanced reporting solutions. He has 7+ years of experience delivering scalable enterprise applications across diverse domains.Specializing in Node.js, JavaScript, Angular, and DevOps, Darshak brings robust debugging and problem-solving skills to every project. Passionate about knowledge sharing, he actively contributes insights and best practices to the broader developer community.

Tell us a bit about your needs and our team will reach out to discuss how we can help.

Prefer mail? info@solutionanalysts.com